Document Management

End-to-end document lifecycle automation: from evidence collection to multi-party e-signature and notarization

Document Management

End-to-end document lifecycle automation: from evidence collection to multi-party e-signature and notarization

Document Management

End-to-end document lifecycle automation: from evidence collection to multi-party e-signature and notarization

Document Management

End-to-end document lifecycle automation: from evidence collection to multi-party e-signature and notarization

Collect documents without weeks of phone calls, emails, and follow-ups. Our platform automates the complete document lifecycle from evidence collection through delivery, acknowledgment, signature, and notarization, reducing administrative burden and accelerating claim decisions.

Unlike generic e-signature tools, it's built for insurance workflows, automatically collecting evidence in any format, delivering pre-filled documents, tracking every interaction, and routing completed documents directly into your claim system with complete audit trails.

Automate evidence collection, e-signatures, and notarization without weeks of follow-up.

The Gain Life Platform Advantage

Current Workflow

Current Workflow

With Gain Life

With Gain Life

What This Means for Your Team

What This Means for Your Team

Manual printing, mailing, and scanning of wet signatures

Electronic signatures with auto-fill delivered instantly, supporting single or multiple signers

Completion times reduced from weeks to hours

Manual printing, mailing, and scanning of wet signatures

Electronic signatures with auto-fill delivered instantly, supporting single or multiple signers

Completion times reduced from weeks to hours

Manual printing, mailing, and scanning of wet signatures

Electronic signatures with auto-fill delivered instantly, supporting single or multiple signers

Completion times reduced from weeks to hours

Manual printing, mailing, and scanning of wet signatures

Electronic signatures with auto-fill delivered instantly, supporting single or multiple signers

Completion times reduced from weeks to hours

Manual document requests and evidence collection requiring repeated calls and emails

Automated collection of pictures, documents, videos, and forms with intelligent follow-up workflows

Adjusters focus on claim decisions while collection runs automatically

Manual document requests and evidence collection requiring repeated calls and emails

Automated collection of pictures, documents, videos, and forms with intelligent follow-up workflows

Adjusters focus on claim decisions while collection runs automatically

Manual document requests and evidence collection requiring repeated calls and emails

Automated collection of pictures, documents, videos, and forms with intelligent follow-up workflows

Adjusters focus on claim decisions while collection runs automatically

Manual document requests and evidence collection requiring repeated calls and emails

Automated collection of pictures, documents, videos, and forms with intelligent follow-up workflows

Adjusters focus on claim decisions while collection runs automatically

No visibility into whether documents have been received or reviewed

Real-time tracking showing when documents are delivered, opened, read, acknowledged, signed, or notarized

Complete transparency with proactive follow-up on outstanding items

No visibility into whether documents have been received or reviewed

Real-time tracking showing when documents are delivered, opened, read, acknowledged, signed, or notarized

Complete transparency with proactive follow-up on outstanding items

No visibility into whether documents have been received or reviewed

Real-time tracking showing when documents are delivered, opened, read, acknowledged, signed, or notarized

Complete transparency with proactive follow-up on outstanding items

No visibility into whether documents have been received or reviewed

Real-time tracking showing when documents are delivered, opened, read, acknowledged, signed, or notarized

Complete transparency with proactive follow-up on outstanding items

Why Our Approach Works

Insurance-Native Document Workflows

We designed our platform for the complete document lifecycle claims teams manage: collecting evidence in any format (pictures, documents, videos), delivering pre-filled forms with data automatically populated from your claim system, tracking when documents are read and acknowledged, routing for single or multi-party e-signatures, and enabling 24/7 electronic notarization. Our workflows automatically request and validate evidence based on business rules and jurisdictional requirements.

Business teams configure, IT stays in control

Configure document types, evidence collection rules, auto-fill parameters, signature workflows, and notarization requirements to your compliance requirements. Multi-party e-signature sequences configure to jurisdictional needs. IT maintains governance through role-based permissions and audit trails.

Works Within Your Infrastructure

Completed documents flow directly into claim systems with comprehensive audit trails capturing when each document was delivered, opened, read, acknowledged, signed by each party, or notarized. Every claimant action triggers configurable alerts to adjuster inboxes. Supports Managed SFTP with triggers and missing-file alerts, as well as read-only imports from core claim systems for centralized document control.

One Comprehensive Platform

Document workflows connect with messaging, portals, and claims monitoring, ensuring evidence requests, document delivery, e-signatures, and acknowledgments are integrated into the broader claims process, not siloed in separate tools.

Rapid Deployment & Integration Support

Connects to your systems via secure APIs and managed file exchange. Typical go-live is 4-6 weeks, with Gain Life handling configuration. No IT required once dataflows are established.

Why Our Approach Works

Insurance-Native Document Workflows

We designed our platform for the complete document lifecycle claims teams manage: collecting evidence in any format (pictures, documents, videos), delivering pre-filled forms with data automatically populated from your claim system, tracking when documents are read and acknowledged, routing for single or multi-party e-signatures, and enabling 24/7 electronic notarization. Our workflows automatically request and validate evidence based on business rules and jurisdictional requirements.

Business teams configure, IT stays in control

Configure document types, evidence collection rules, auto-fill parameters, signature workflows, and notarization requirements to your compliance requirements. Multi-party e-signature sequences configure to jurisdictional needs. IT maintains governance through role-based permissions and audit trails.

Works Within Your Infrastructure

Completed documents flow directly into claim systems with comprehensive audit trails capturing when each document was delivered, opened, read, acknowledged, signed by each party, or notarized. Every claimant action triggers configurable alerts to adjuster inboxes. Supports Managed SFTP with triggers and missing-file alerts, as well as read-only imports from core claim systems for centralized document control.

One Comprehensive Platform

Document workflows connect with messaging, portals, and claims monitoring, ensuring evidence requests, document delivery, e-signatures, and acknowledgments are integrated into the broader claims process, not siloed in separate tools.

Rapid Deployment & Integration Support

Connects to your systems via secure APIs and managed file exchange. Typical go-live is 4-6 weeks, with Gain Life handling configuration. No IT required once dataflows are established.

Why Our Approach Works

Insurance-Native Document Workflows

We designed our platform for the complete document lifecycle claims teams manage: collecting evidence in any format (pictures, documents, videos), delivering pre-filled forms with data automatically populated from your claim system, tracking when documents are read and acknowledged, routing for single or multi-party e-signatures, and enabling 24/7 electronic notarization. Our workflows automatically request and validate evidence based on business rules and jurisdictional requirements.

Business teams configure, IT stays in control

Configure document types, evidence collection rules, auto-fill parameters, signature workflows, and notarization requirements to your compliance requirements. Multi-party e-signature sequences configure to jurisdictional needs. IT maintains governance through role-based permissions and audit trails.

Works Within Your Infrastructure

Completed documents flow directly into claim systems with comprehensive audit trails capturing when each document was delivered, opened, read, acknowledged, signed by each party, or notarized. Every claimant action triggers configurable alerts to adjuster inboxes. Supports Managed SFTP with triggers and missing-file alerts, as well as read-only imports from core claim systems for centralized document control.

One Comprehensive Platform

Document workflows connect with messaging, portals, and claims monitoring, ensuring evidence requests, document delivery, e-signatures, and acknowledgments are integrated into the broader claims process, not siloed in separate tools.

Rapid Deployment & Integration Support

Connects to your systems via secure APIs and managed file exchange. Typical go-live is 4-6 weeks, with Gain Life handling configuration. No IT required once dataflows are established.

Why Our Approach Works

Insurance-Native Document Workflows

We designed our platform for the complete document lifecycle claims teams manage: collecting evidence in any format (pictures, documents, videos), delivering pre-filled forms with data automatically populated from your claim system, tracking when documents are read and acknowledged, routing for single or multi-party e-signatures, and enabling 24/7 electronic notarization. Our workflows automatically request and validate evidence based on business rules and jurisdictional requirements.

Business teams configure, IT stays in control

Configure document types, evidence collection rules, auto-fill parameters, signature workflows, and notarization requirements to your compliance requirements. Multi-party e-signature sequences configure to jurisdictional needs. IT maintains governance through role-based permissions and audit trails.

Works Within Your Infrastructure

Completed documents flow directly into claim systems with comprehensive audit trails capturing when each document was delivered, opened, read, acknowledged, signed by each party, or notarized. Every claimant action triggers configurable alerts to adjuster inboxes. Supports Managed SFTP with triggers and missing-file alerts, as well as read-only imports from core claim systems for centralized document control.

One Comprehensive Platform

Document workflows connect with messaging, portals, and claims monitoring, ensuring evidence requests, document delivery, e-signatures, and acknowledgments are integrated into the broader claims process, not siloed in separate tools.

Rapid Deployment & Integration Support

Connects to your systems via secure APIs and managed file exchange. Typical go-live is 4-6 weeks, with Gain Life handling configuration. No IT required once dataflows are established.

Real-World Applications

Electronic notarization for a GL Claim

With just one click an adjuster can send a claimant their settlement paperwork, which the claimant can get signed 24/7 in minutes via their phone, and that completed/notarized document automatically routes directly into the claim file.

Electronic notarization for a GL Claim

With just one click an adjuster can send a claimant their settlement paperwork, which the claimant can get signed 24/7 in minutes via their phone, and that completed/notarized document automatically routes directly into the claim file.

Electronic notarization for a GL Claim

With just one click an adjuster can send a claimant their settlement paperwork, which the claimant can get signed 24/7 in minutes via their phone, and that completed/notarized document automatically routes directly into the claim file.

Electronic notarization for a GL Claim

With just one click an adjuster can send a claimant their settlement paperwork, which the claimant can get signed 24/7 in minutes via their phone, and that completed/notarized document automatically routes directly into the claim file.

Automated Evidence Collection

A property damage claim requires photo documentation. The platform automatically requests evidence via the claimant's preferred channel, validates submissions, and follows-up as necessary based on business rules.

Automated Evidence Collection

A property damage claim requires photo documentation. The platform automatically requests evidence via the claimant's preferred channel, validates submissions, and follows-up as necessary based on business rules.

Automated Evidence Collection

A property damage claim requires photo documentation. The platform automatically requests evidence via the claimant's preferred channel, validates submissions, and follows-up as necessary based on business rules.

Automated Evidence Collection

A property damage claim requires photo documentation. The platform automatically requests evidence via the claimant's preferred channel, validates submissions, and follows-up as necessary based on business rules.

In-app Document Previews

Claimants and adjusters review documents before submission to reduce errors.

In-app Document Previews

Claimants and adjusters review documents before submission to reduce errors.

In-app Document Previews

Claimants and adjusters review documents before submission to reduce errors.

In-app Document Previews

Claimants and adjusters review documents before submission to reduce errors.

Bulk Uploads

Enables high-volume evidence collection and processing in a single step.

Bulk Uploads

Enables high-volume evidence collection and processing in a single step.

Bulk Uploads

Enables high-volume evidence collection and processing in a single step.

Bulk Uploads

Enables high-volume evidence collection and processing in a single step.

Integrated Workflow Triggers

Completed signatures or uploads automatically advance claim status and initiate the next steps.

Integrated Workflow Triggers

Completed signatures or uploads automatically advance claim status and initiate the next steps.

Integrated Workflow Triggers

Completed signatures or uploads automatically advance claim status and initiate the next steps.

Integrated Workflow Triggers

Completed signatures or uploads automatically advance claim status and initiate the next steps.

Regulatory Acknowledgments

Notices requiring proof of delivery and acknowledgment are automatically tracked with read receipts and audit logs.

Regulatory Acknowledgments

Notices requiring proof of delivery and acknowledgment are automatically tracked with read receipts and audit logs.

Regulatory Acknowledgments

Notices requiring proof of delivery and acknowledgment are automatically tracked with read receipts and audit logs.

Regulatory Acknowledgments

Notices requiring proof of delivery and acknowledgment are automatically tracked with read receipts and audit logs.

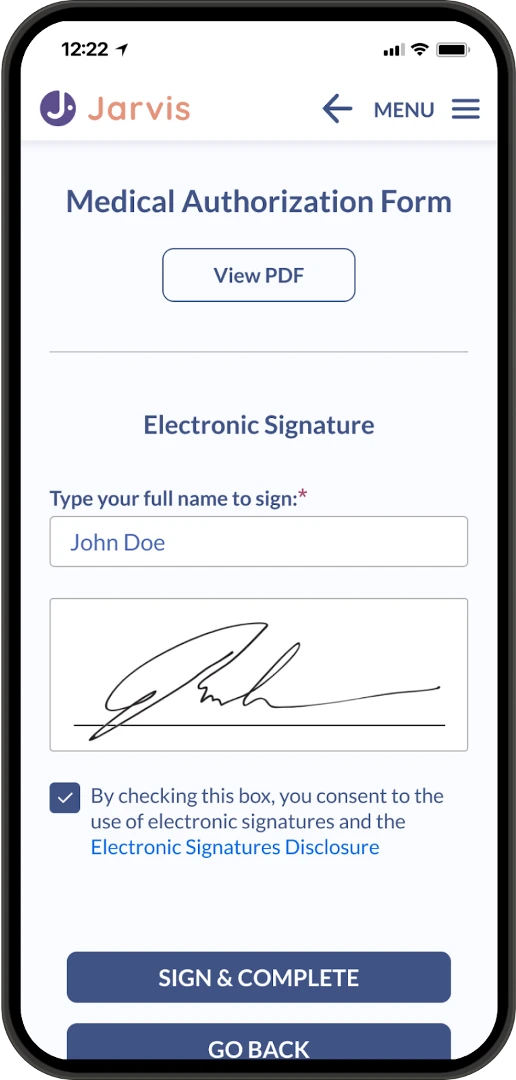

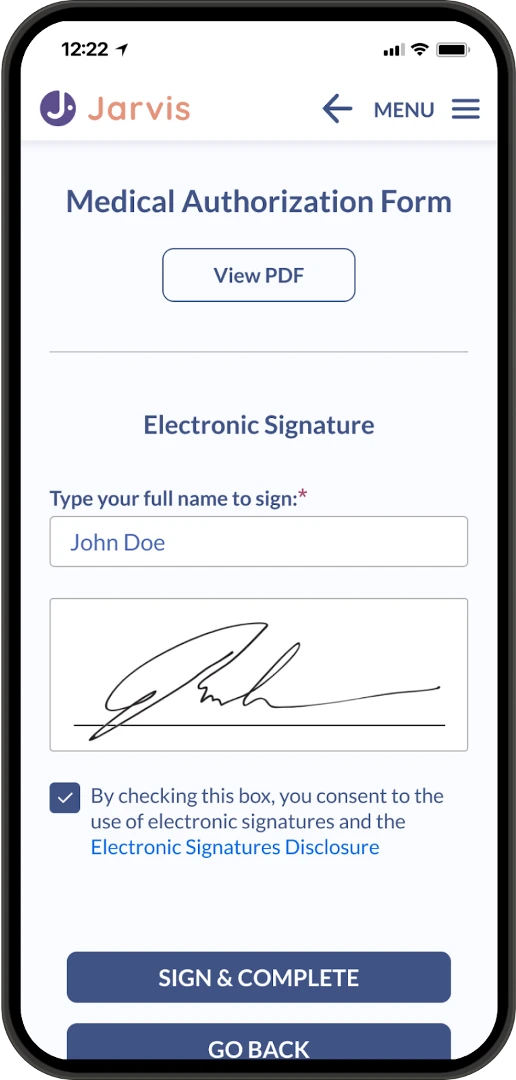

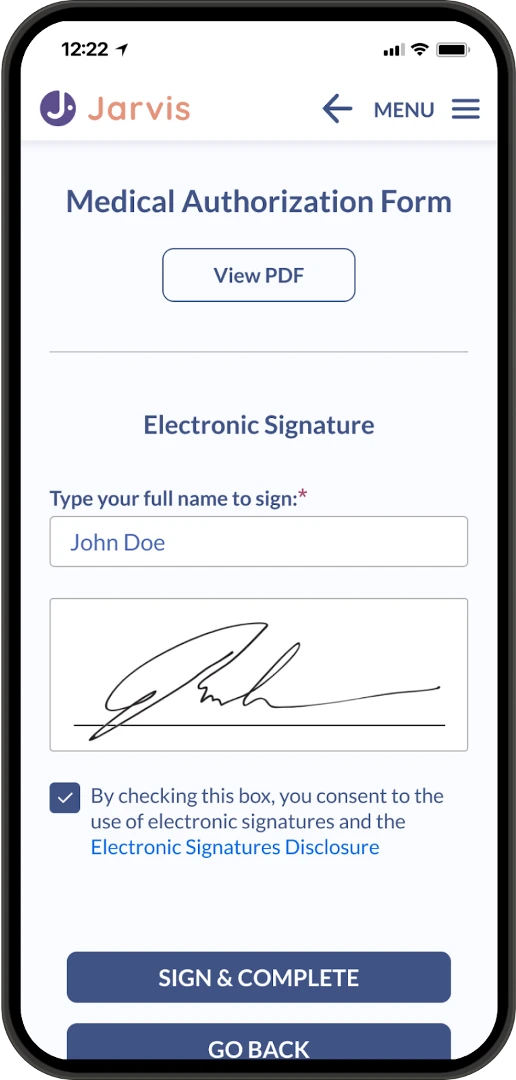

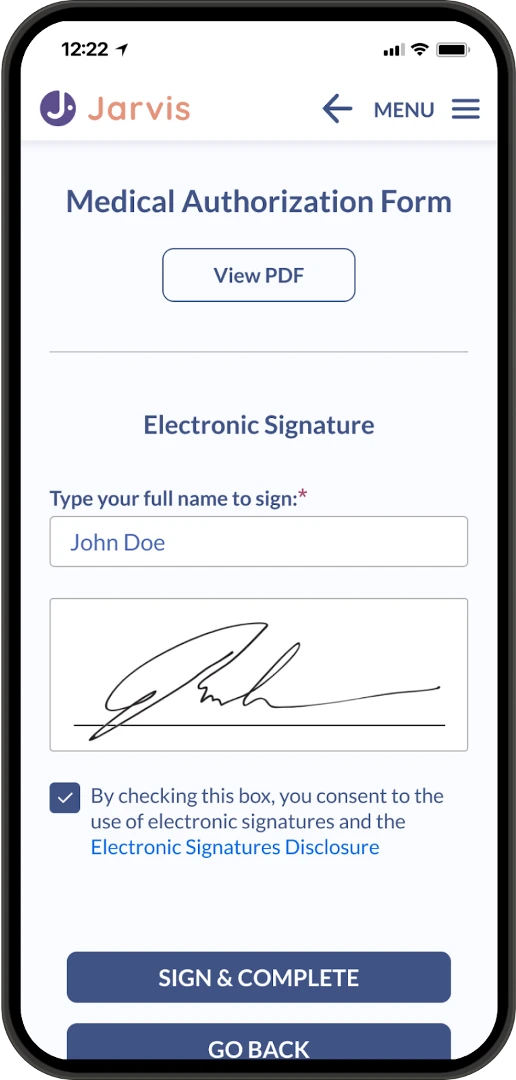

Medical Authorization in Workers’ Compensation

Claimants automatically receive a pre-filled medical authorization that they can sign/authorize with just a keystroke on their phone, automatically sending the completed document back to your claim system while the claimant has a signed copy on their device for their own records.

Medical Authorization in Workers’ Compensation

Claimants automatically receive a pre-filled medical authorization that they can sign/authorize with just a keystroke on their phone, automatically sending the completed document back to your claim system while the claimant has a signed copy on their device for their own records.

Medical Authorization in Workers’ Compensation

Claimants automatically receive a pre-filled medical authorization that they can sign/authorize with just a keystroke on their phone, automatically sending the completed document back to your claim system while the claimant has a signed copy on their device for their own records.

Medical Authorization in Workers’ Compensation

Claimants automatically receive a pre-filled medical authorization that they can sign/authorize with just a keystroke on their phone, automatically sending the completed document back to your claim system while the claimant has a signed copy on their device for their own records.

Proven Results You Can Measure

Document completion reduced from weeks to hours through automated document collection

Document completion reduced from weeks to hours through automated document collection

Document completion reduced from weeks to hours through automated document collection

Document completion reduced from weeks to hours through automated document collection

End-to-end document workflows with validated photo/document uploads

End-to-end document workflows with validated photo/document uploads

End-to-end document workflows with validated photo/document uploads

End-to-end document workflows with validated photo/document uploads

Consistent compliance with complete audit trails for every document interaction

Consistent compliance with complete audit trails for every document interaction

Consistent compliance with complete audit trails for every document interaction

Consistent compliance with complete audit trails for every document interaction

Purpose-built for P&C workflows with 5+ years of insurance-specific document intelligence

Purpose-built for P&C workflows with 5+ years of insurance-specific document intelligence

Purpose-built for P&C workflows with 5+ years of insurance-specific document intelligence

Purpose-built for P&C workflows with 5+ years of insurance-specific document intelligence

Route compliant documents straight to your claim system with full audit trails, no paper chasing required.

Route compliant documents straight to your claim system with full audit trails, no paper chasing required.

Route compliant documents straight to your claim system with full audit trails, no paper chasing required.